Forex Trading Basics A Comprehensive Guide for Beginners 1593456157

Forex trading, or foreign exchange trading, is a vast and dynamic market where currencies are exchanged. As the largest financial market in the world, Forex attracts millions of traders and investors eager to profit from currency fluctuations. This article aims to provide a comprehensive overview of the basics of Forex trading to help beginners get started. For more detailed insights, visit forex trading basics https://forex-level.com/.

Understanding Forex Trading

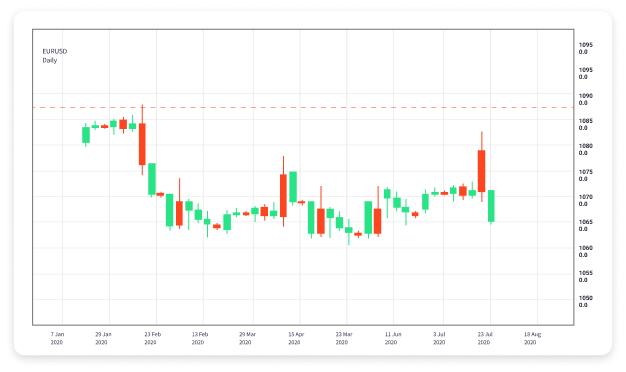

Forex trading involves buying one currency while simultaneously selling another. This is done through a trading platform provided by a broker. The currencies are traded in pairs, and their exchange rates fluctuate based on various factors such as economic indicators, interest rates, and market sentiment. For instance, if you're trading the EUR/USD pair, you are buying euros while selling US dollars.

Key Terminology in Forex Trading

Before diving into trading, it's essential to understand some basic terms commonly used in Forex:

- Currency Pair: The quotation of two different currencies, with one currency being the base currency and the other the quote currency.

- Pip: The smallest price move that a given exchange rate can make, usually the fourth decimal place.

- Lot: A standard unit of measure in Forex trading. A standard lot is typically equivalent to 100,000 units of the base currency.

- Leverage: A mechanism that allows traders to control larger positions with a smaller amount of capital, magnifying both potential profits and losses.

- Spread: The difference between the buying (ask) and selling (bid) price of a currency pair.

- Margin: The amount of money required to open a position, usually expressed as a percentage of the full value of the position.

How to Start Trading Forex

Starting Forex trading can seem daunting, but with a structured approach, you can navigate the market effectively. Here are some steps to help you begin:

- Choose a Reliable Broker: Research and choose a broker that fits your needs. Look for one that is regulated, offers a user-friendly platform, and has favorable trading conditions.

- Create a Trading Account: After selecting a broker, you'll need to open a trading account. Most brokers offer a demo account that allows you to practice without risking real money.

- Learn Technical and Fundamental Analysis: Develop an understanding of both technical analysis (chart patterns, indicators) and fundamental analysis (economic indicators, news events) to make informed trading decisions.

- Develop a Trading Plan: A solid trading plan outlines your trading goals, risk management, and strategies. Stick to your plan to avoid emotional trading.

- Start Trading: Once you feel confident, start trading with real money. Begin with small amounts to minimize risk as you gain experience.

Types of Forex Trading Strategies

There are various strategies traders employ, which can be broadly categorized into three types: scalping, day trading, and swing trading.

- Scalping: A short-term strategy aiming to make quick profits from small price movements. Scalpers often take numerous trades throughout the day.

- Day Trading: Involves buying and selling currencies within the same trading day to capitalize on short-term market movements. Day traders close all trades by the end of the day to avoid overnight risks.

- Swing Trading: This strategy focuses on holding positions for several days or weeks. Swing traders aim to profit from medium-term price movements and often use technical analysis to identify potential entry and exit points.

Risk Management in Forex Trading

Forex trading carries inherent risks, and effective risk management is crucial to protect your capital. Here are some key risk management techniques:

- Use Stop-Loss Orders: A stop-loss order automatically closes a trade when it reaches a certain price, limiting potential losses.

- Set Risk-to-Reward Ratios: Aim for trades where the potential reward outweighs the risk. A common ratio is 1:2 or 1:3.

- Diversify Your Portfolio: Don't put all your funds into one currency pair. Diversification can help mitigate risks associated with market volatility.

- Use Proper Position Sizing: Determine how much of your capital to risk on each trade, typically no more than 1-2% of your total account balance.

The Importance of Staying Informed

To succeed in Forex trading, staying informed about global economic events and trends is vital. Monitor news releases, economic calendars, and market commentary to gain insights into potential price movements. Being aware of geopolitical events, central bank decisions, and economic indicators can provide a competitive edge in your trading decisions.

Common Mistakes to Avoid as a Beginner

Many new traders make common mistakes that can hinder their success. Here are some pitfalls to avoid:

- Lack of a Trading Plan: Trading without a plan can lead to emotional decisions and increased risk.

- Over-Leveraging: Using too much leverage can amplify losses, leading to significant account drawdowns.

- Ignoring Economic Fundamentals: Neglecting to consider economic factors can result in poor trading decisions.

- Chasing Losses: Avoid the temptation to double down on losing trades in hopes of recovering losses. Stick to your trading plan.

- Failing to Keep a Trading Journal: Keeping a record of your trades can help you analyze your performance and refine your strategies.

Conclusion

Forex trading can be a profitable endeavor if approached with the right knowledge and strategies. By understanding the basics, developing a solid trading plan, and practicing effective risk management, you set yourself up for success in the Forex market. Remember that continuous learning and adaptation are crucial as the market evolves. Good luck on your trading journey!

- ! Без рубрики

- 123

- 1bet5

- 1w

- 1Win AZ Casino

- 1win casino spanish

- 1win fr

- 1win Turkiye

- 1winRussia

- 1x-bet.downloa

- 1xbet

- 1xbet apk

- 1xbet Bangladesh

- 1xbet Casino AZ

- 1xbet casino BD

- 1xbet india

- 1xbet Korea

- 1xbet KR

- 1xbet malaysia

- 1xbet Morocco

- 1xbet pt

- 1xbet RU

- 1xbet russian

- 1xbet russian1

- 1xbet-uzbek.org

- 1xbet1

- 1xbet2

- 1xbet3

- 1xbet32

- 1xbet3231025

- 1xbet4

- 1xbet51

- 1xbet52

- 1xbet61

- 1xbet62

- 1xbet82

- 22bet

- 22Bet BD

- 22bet IT

- 22betde.de

- 888starz bd

- a16z generative ai

- a16z generative ai 1

- Aanbiedingen

- aarhusaffairs.dk

- adobe generative ai 1

- adobe generative ai 2

- ai chat bot python

- ambridgeevents.com

- AU T1_19264 (3)

- austria

- Aviator

- aviator brazil

- aviator casino DE

- aviator casino fr

- aviator IN

- aviator ke

- aviator mz

- aviator ng

- b1bet BR

- bbrbet colombia

- bbrbet mx

- bcg4

- bcgame1

- bcgame2

- bcgame3

- beach5.ch_betonred

- bet1

- bet2

- betting2

- betwinner1

- betwinner2

- bizzo casino

- blog

- book of ra it

- Brand

- brucebetdeutsch.com

- Canada Casino

- casibom tr

- casino

- casino en ligne argent reel

- casino en ligne fr

- casino svensk licens

- casino utan svensk licens

- casino zonder crucks netherlands

- casino-glory india

- casino1

- casino101

- casino102

- casino103

- casino2

- casino201

- casino202

- casino203

- casino241

- casino242

- casino25

- casino27

- casino3

- casino4

- casino5

- casino6

- casino7

- casinos1

- chat bot names 4

- ciroblazevic.hr

- cityoflondonmile3

- cityoflondonmile4

- comedychristmas.ch

- crazy time

- csdino

- Cursussen

- done

- DONE 240679 Kli 09.10

- DONE 241993 16.10

- DONE 4447 Focus 13.10

- done 7 slots

- drivein.hr

- dxgamestudio.com

- extradition

- focus basari

- fortune tiger brazil

- freevoice.hr

- fysiotek.gr

- fzo.hr

- Gama Casino

- Game

- gameaviatorofficial.com

- gate-of-olympus.gr

- Gegmany Casino3

- Gegmany Casino5

- how does generative ai work

- icestupa10

- icestupa13

- icestupa2

- icestupa3

- icestupa4

- icestupa5

- icestupa6

- icestupa9

- IGAMING

- imageloop.ru 20

- Indonesia Casino

- italiandocscreening

- ivibetcasino.ch

- jaya91

- kaszino1

- khelo24betoficcial.com

- king johnnie

- lilyedu.uz

- Maribet casino TR

- Maxi reviewe

- mini-review

- Mini-reviews

- mombrand

- mono brand

- mono slot

- Mono-brand

- Monobrand

- monobrend

- monogame

- monoslot

- moon-princess-100.com

- mostbet

- mostbet GR

- mostbet hungary

- mostbet italy

- mostbet norway

- mostbet tr

- Mr Bet casino DE

- mr jack bet brazil

- mx-bbrbet-casino

- my-1xbet.com

- news

- Nieuws

- omitapparel

- ozwin au casino

- Pacifica_bl95un3ifza

- palazzocornermocenigo

- PBN

- pelican casino PL

- Pin UP

- Pin Up Brazil

- Pin UP Online Casino

- Pin Up Peru

- pin-up-casino-giris.net

- pinco

- Pinco türkiye

- PinUp

- Pinup casino

- pınco

- plinko

- plinko in

- plinko UK

- plinko_pl

- pocketoption1

- pocketoption2

- pocketoption3

- Post

- primexbt1

- primexbt2

- primexbt3

- Qizilbilet

- Ramenbet

- Ramenbet

- Review

- Reviewe

- reviewer

- rise-of-olympus-100.com.gr

- sansalvatrail.ch

- schweizbahigo.ch

- Shows

- Slot

- Slots

- Slots`

- space-interiors

- sudstvo.mk

- sugar rush

- sugar-rush-1000.com.gr

- sweet bonanza

- T3_19264_a

- Thailand Casino

- thereoncewasacurl.com

- Trading3

- trading5

- traiding1

- traiding2

- traiding4

- UK Casino

- ulola.hr

- Uncategorized

- vavada1

- verde casino poland

- verde casino romania

- Vovan Casino

- vulkan vegas germany

- weight loss pharmacy

- Комета Казино

- Макси-обзорник

- нуы

- сателлиты

- сеточный домен