How to Open a Forex Trading Account A Comprehensive Guide 1554398454

How to Open a Forex Trading Account: A Comprehensive Guide

If you've ever thought about venturing into the world of Forex trading, you're not alone. Forex, or foreign exchange trading, is one of the largest and most liquid financial markets in the world. With a daily trading volume that exceeds $6 trillion, it offers a multitude of opportunities for traders. However, getting started can seem daunting. In this guide, we will provide a detailed overview of the steps involved in opening a Forex account, including selecting a broker, the necessary documentation, and trading platforms. Be sure to check out the how to open a forex trading account Top LATAM Forex Platforms to find the right broker for your needs.

1. Understanding Forex Trading

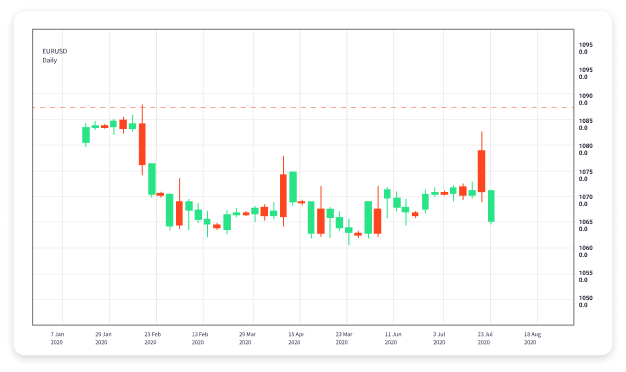

Before diving into the process of opening a Forex account, it's essential to understand what Forex trading entails. Forex trading involves the buying and selling of currency pairs with the aim of making a profit. Currency pairs consist of a base currency and a quote currency. For example, in the pair EUR/USD, the Euro is the base currency, and the US dollar is the quote currency.

2. Choosing the Right Forex Broker

Once you understand Forex trading, the next step is to choose a suitable Forex broker. When selecting a broker, consider the following factors:

- Regulation: Ensure that the broker is regulated by reputable financial authorities.

- Trading Platform: Look for a user-friendly trading platform that suits your trading style.

- Spreads and Commissions: Compare the fees associated with different brokers to find the most cost-effective option.

- Client Support: Good customer service can make a significant difference in your trading experience.

- Account Types: Brokers often offer various account types with different minimum deposit requirements and features.

3. Creating Your Trading Account

Once you've selected a broker, the next step is to create your trading account. This process typically involves the following steps:

Step 1: Registration

Visit the broker's website and fill out the registration form. You'll need to provide personal information such as your name, email address, and phone number.

Step 2: Verify Your Identity

Most reputable Forex brokers require you to verify your identity as part of the Know Your Customer (KYC) regulations. This may involve uploading documents such as a government-issued ID, proof of address, and sometimes a tax identification number.

Step 3: Fund Your Account

After your account is verified, you'll need to fund it. Most brokers offer various funding methods, including bank transfers, credit/debit cards, and e-wallets. Be sure to check the minimum deposit requirements for your chosen account type.

4. Choosing a Trading Platform

Once your account is funded, the next step is to select a trading platform. Many brokers offer a proprietary trading platform, while others provide access to popular platforms such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5). The trading platform is where you'll execute your trades, so it's important to choose one that you find intuitive and easy to navigate.

5. Developing a Trading Plan

Before you start trading, it's vital to have a clear trading plan in place. A trading plan outlines your trading goals, risk tolerance, and strategies. Consider factors such as your trading style (day trading, swing trading, etc.), preferred currency pairs, and how much capital you're willing to risk on each trade. By having a well-defined trading plan, you'll be better equipped to manage your trades and avoid impulsive decisions driven by emotion.

6. Practicing with a Demo Account

Many brokers offer demo accounts that allow you to practice trading with virtual funds. This is a great way to familiarize yourself with the trading platform and test your strategies without risking real money. Take advantage of this opportunity to develop your skills and gain confidence before moving on to live trading.

7. Placing Your First Trade

Once you're comfortable with the trading platform and have developed a trading plan, it’s time to place your first trade. Be sure to thoroughly analyze the market conditions, and use tools such as chart analysis, indicators, and news reports to inform your decisions. Start small, and don’t be afraid to learn from your mistakes.

8. Continuing Education and Strategy Improvement

The Forex market is continually changing, and staying informed is crucial for success. Consider regularly engaging with educational resources like webinars, articles, and trading courses. Join trading communities or forums where you can share experiences, discuss strategies, and learn from others. Continuously refine your strategy based on your experiences and market changes.

Conclusion

Opening a Forex trading account is the first step toward participating in one of the most dynamic markets in the world. By carefully selecting a broker, verifying your account, and developing a solid trading plan, you can set yourself up for success. Remember, trading involves risk, and it's essential to approach it with a well-informed, disciplined mindset. Good luck, and happy trading!

- ! Без рубрики

- 123

- 1bet5

- 1w

- 1Win AZ Casino

- 1win casino spanish

- 1win fr

- 1win Turkiye

- 1winRussia

- 1x-bet.downloa

- 1xbet

- 1xbet apk

- 1xbet Bangladesh

- 1xbet Casino AZ

- 1xbet casino BD

- 1xbet india

- 1xbet Korea

- 1xbet KR

- 1xbet malaysia

- 1xbet Morocco

- 1xbet pt

- 1xbet RU

- 1xbet russian

- 1xbet russian1

- 1xbet-uzbek.org

- 1xbet1

- 1xbet2

- 1xbet3

- 1xbet32

- 1xbet3231025

- 1xbet4

- 1xbet51

- 1xbet52

- 1xbet61

- 1xbet62

- 1xbet82

- 22bet

- 22Bet BD

- 22bet IT

- 22betde.de

- 888starz bd

- a16z generative ai

- a16z generative ai 1

- Aanbiedingen

- aarhusaffairs.dk

- adobe generative ai 1

- adobe generative ai 2

- ai chat bot python

- ambridgeevents.com

- armommy.com

- AU T1_19264 (3)

- austria

- Aviator

- aviator brazil

- aviator casino DE

- aviator casino fr

- aviator IN

- aviator ke

- aviator mz

- aviator ng

- b1bet BR

- bbrbet colombia

- bbrbet mx

- bcg4

- bcgame1

- bcgame2

- bcgame3

- beach5.ch_betonred

- bet1

- bet2

- betting2

- betwinner1

- betwinner2

- bizzo casino

- blog

- book of ra it

- Brand

- brucebetdeutsch.com

- Canada Casino

- casibom tr

- casino

- casino en ligne argent reel

- casino en ligne fr

- casino svensk licens

- casino utan svensk licens

- casino zonder crucks netherlands

- casino-glory india

- casino1

- casino101

- casino102

- casino103

- casino2

- casino201

- casino202

- casino203

- casino241

- casino242

- casino25

- casino27

- casino3

- casino4

- casino5

- casino6

- casino7

- casino8

- casinobet1

- casinos1

- chat bot names 4

- ciroblazevic.hr

- cityoflondonmile3

- cityoflondonmile4

- comedychristmas.ch

- crazy time

- csdino

- Cursussen

- done

- DONE 240679 Kli 09.10

- DONE 241993 16.10

- DONE 4447 Focus 13.10

- done 7 slots

- drivein.hr

- droughtwatch.eu

- dxgamestudio.com

- extradition

- focus basari

- fortune tiger brazil

- freevoice.hr

- fysiotek.gr

- fzo.hr

- Gama Casino

- Game

- gameaviatorofficial.com

- gate-of-olympus.gr

- Gegmany Casino3

- Gegmany Casino5

- how does generative ai work

- icestupa10

- icestupa13

- icestupa2

- icestupa3

- icestupa4

- icestupa5

- icestupa6

- icestupa9

- IGAMING

- imageloop.ru 20

- Indonesia Casino

- Indonsia Slot Gacor

- italiandocscreening

- ivibetcasino.ch

- jaya91

- kaszino1

- khelo24betoficcial.com

- king johnnie

- lilyedu.uz

- Maribet casino TR

- Maxi reviewe

- mini-review

- Mini-reviews

- mombrand

- mono brand

- mono slot

- Mono-brand

- Monobrand

- monobrend

- monogame

- monoslot

- moon-princess-100.com

- mostbet

- mostbet GR

- mostbet hungary

- mostbet italy

- mostbet norway

- mostbet tr

- Mr Bet casino DE

- mr jack bet brazil

- mx-bbrbet-casino

- my-1xbet.com

- news

- Nieuws

- omitapparel

- ozwin au casino

- Pacifica_bl95un3ifza

- palazzocornermocenigo

- PBN

- pelican casino PL

- Pin UP

- Pin Up Brazil

- Pin UP Online Casino

- Pin Up Peru

- pin-up-casino-giris.net

- pinco

- Pinco türkiye

- PinUp

- Pinup casino

- pınco

- plinko

- plinko in

- plinko UK

- plinko_pl

- pocketoption1

- pocketoption2

- pocketoption3

- Post

- primexbt1

- primexbt2

- primexbt3

- Qizilbilet

- Ramenbet

- Ramenbet

- Review

- Reviewe

- reviewer

- rise-of-olympus-100.com.gr

- sansalvatrail.ch

- schweizbahigo.ch

- Shows

- Slot

- Slots

- Slots`

- space-interiors

- sudstvo.mk

- sugar rush

- sugar-rush-1000.com.gr

- sweet bonanza

- T3_19264_a

- Thailand Casino

- thereoncewasacurl.com

- Trading3

- trading5

- trading6

- trading7

- trading8

- traiding1

- traiding2

- traiding4

- UK Casino

- ulola.hr

- Uncategorized

- vavada1

- vavada11.ink

- vavada11.live

- vavada11.store

- vavada8.space

- vavada8.work

- verde casino poland

- verde casino romania

- Vovan Casino

- vulkan vegas germany

- weight loss pharmacy

- Комета Казино

- Макси-обзорник

- нуы

- сателлиты

- сеточный домен